About MilesforTax – Mileage Tracker

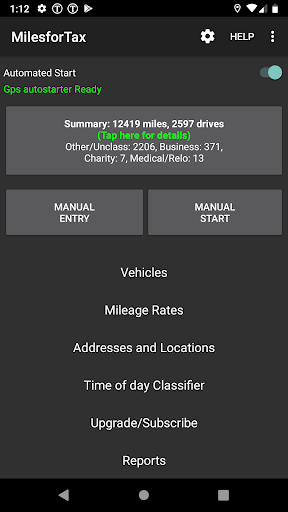

New design – Track, and log your vehicles mileage with MilesforTax. MilesforTax mileage tracker records your mileage for business, charity, medical usage expense (for taxes) on your smart phone automatically. Easy setup and use with simple controls designed for use in the vehicle at night or during the day. Build in reports.

If you use your vehicle for business, charity, personal etc. MilesforTax provides a convenient hassle free, hands free method to automatically collect your mileage. MilesforTax offers several ways to automatically start and stop recording your mileage. Users can also enter mileage manually. Records fractional miles. All you have to do is install MilesforTax and open it once and all the functions are available.

MilesforTax works in the background even while you use for device for other purposes.

MilesforTax helps get the most out of what you worked so hard for by constantly sensing you environment and uses time tested battery efficient methods to sense your environment and this assure that you don’t miss drives.

When you drive your vehicle MilesforTax:

– Detects your vehicle speed and will start recording your mileage

– Can detect Bluetooth in your device is paired and start/stop recording your drives.

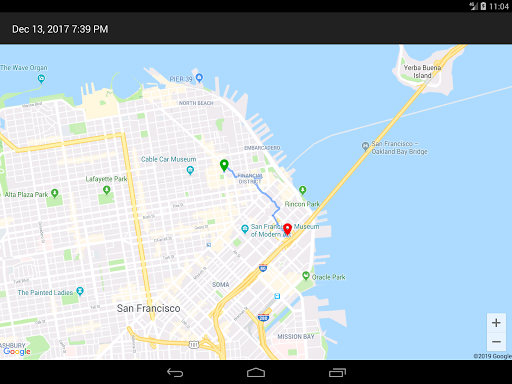

– Record distances and GPS route you traveled from your starting point to your ending point.

– Provide data about your drives when on MilesforTax screens

– Run as a background low so you can use your device for other tasks

MilesforTax Features:

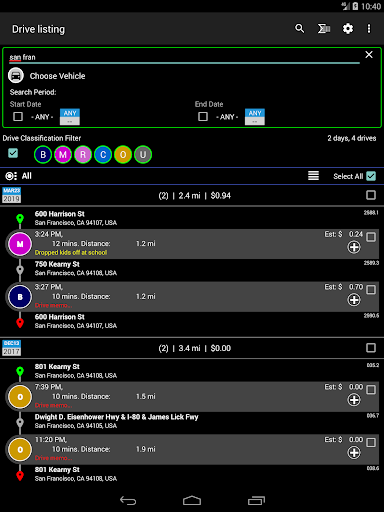

– 6 Drive categories: business, charity medical, other, relocation, unclassified

– GPS automated start/stop

– Bluetooth automated start/stop

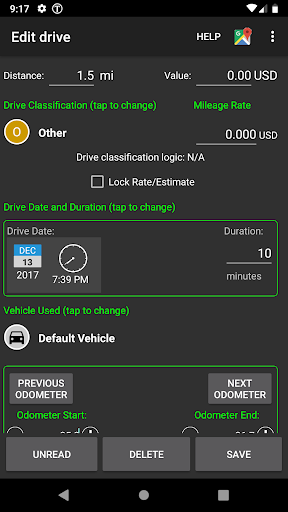

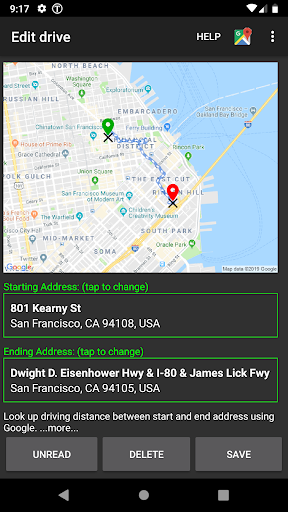

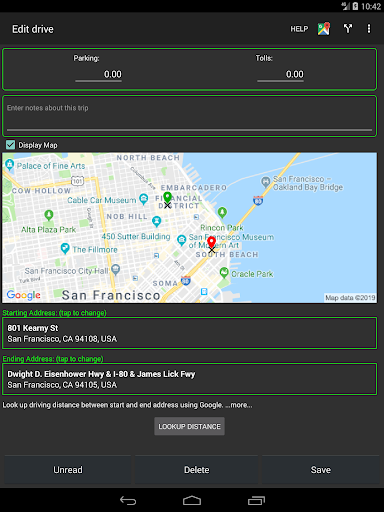

– Manual input or manual changes to drive data.

– Fully editable drives

– Manual start/stop.

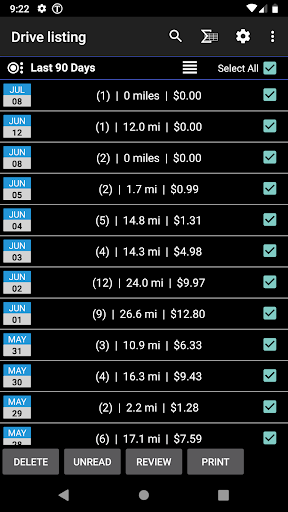

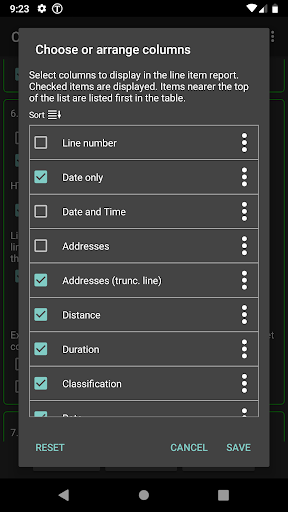

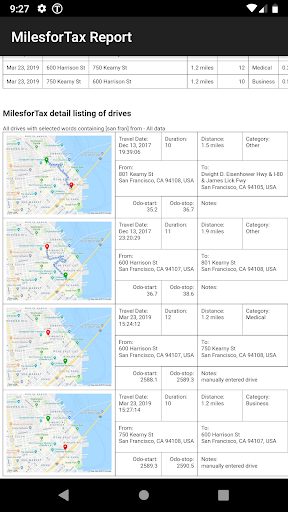

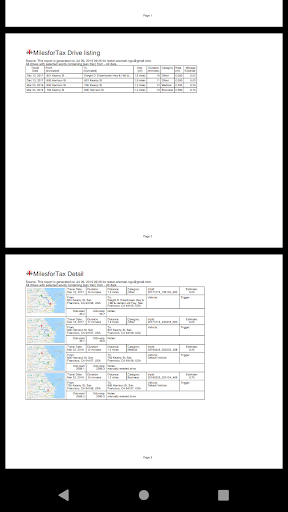

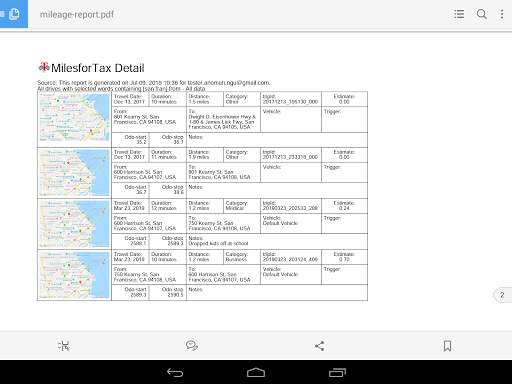

– Miles/KM reports and listings

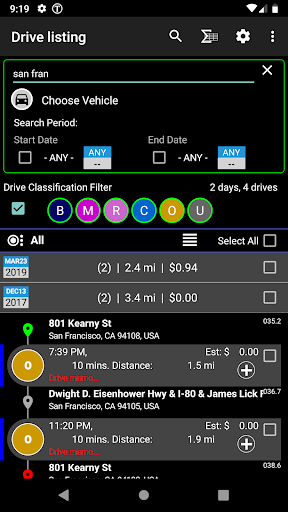

– Search feature.

– Drive notes

– Screen sensitive Help.

– Auto Classify drive by departure/arrival address

– Auto Classify drive by time of day and day in week

– Activate based on time of day and day in week.

– Adjustable odometer (multi-vehicle profiles)

– Support OBD2 via compatible Bluetooth;

– Post drive and in-drive editing with graphical capability.

– On board customization report generation PDF, HTML.

– Export to data to CSV files.

– Automatic recordings include date, duration of drive, start and end locations

– Small footprint, low power (depends on the phone and MilesforTax settings)

– Cloud backup/recovery available.

Turn your forgotten mileage into cash and get the most out of your tax return. You deserve it. Every time you drive MilesforTax records your mileage in the background. Simple to use, automated, hand-off operation. 30 day free trial. ( MilesforTax is an end-to-end mileage tracker solution for recording and documenting mileage.

You will be surprised how many trips and miles go unreported each year!

Operating Requirements

GPS is used to operate MilesforTax. Your installed device must have a functional GPS and while operating in a vehicle the GPS must be able to receive data. Some vehicles have equipment that may prevent the GPS signal from reaching inside the vehicle. Please use the trial period to evaluate if MilesforTax will work for you.

Network Requirements:

MilesforTax does not require data network to record mileage and can be used away from a data network. Some features such as address lookup and mapping require network or internet to acquire content and can use used to manage drives after drives are captured,

Other Requirements:

Android 6 through 13.

Needs either a valid email account or SMS enabled device/phone number

Options for Automation:

– Bluetooth pairing with the vehicles audio systems or (OBD use Bluetooth)

– GPS auto starter.

– Time of day and day in week drive start/classification

– Inexpensive non-audio Bluetooth devices installed in the vehicle

Data is stored in the app, In app purchases via subscription (4.99/month 49.99/yr) for automated starting after 30-day free trial for individuals or business.

Additional App Information

-

Category:

-

Latest Version:buildDate_20231028_173416

-

Released on:Feb 2, 2017

-

Developed by:ANSE SYSTEMS LLC

-

Requires Android:Android 4.4+

-

Available on:

-

Report: